Rates Harmonisation – Overview and FAQs

Overview

Rates across the Central Coast Local Government Area (LGA) will change from July 2021. Rates are changing due to:

- Rates harmonisation which addresses the current rates imbalance from the rate path freeze and align the rating structure across the LGA for all rating categories.

- A 15 percent special variation (SV) rates increase. To help ensure Council’s financial sustainability, the Independent Pricing and Regulatory Tribunal approved the special variation (SV) rates increase for three years – it is a temporary one-off increase and is inclusive of the rate peg.

Step one: Harmonisation of rating structure

Important: Rates harmonisation does not result in any additional income for Council.

Rates harmonisation means that rates are calculated in the same way across the Central Coast to ensure rates levels are fair and equitable. At the time of amalgamation, ratepayers in the former Wyong Shire Council paid higher rates than those in the former Gosford City Council for a property of equivalent value due to a NSW Government rates freeze – rates harmonisation corrects this imbalance.

The rates freeze has been lifted and Central Coast Council will have one rating path/structure for the entire Central Coast Local Government Area from 1 July 2021.

Council is harmonising the minimum ordinary rate to $565 in 2021-22. Harmonising the minimum rate to $565 means that all ratepayers will be levied rates of at least $565 regardless of your property’s land value. Based on current land values the minimum rates will apply to all properties with a land value up to $187,000. Properties with land values above $187,000 will pay more than the minimum rate of $565.

How much Ordinary Rates (less the Domestic Waste Management charge) will go up or down due to harmonisation is largely dependent on the value of land.

Residential land values in the former Gosford City Council area are on average 43 percent higher than those in the former Wyong Shire Council area. This means that former Gosford City Council area ratepayers have been paying significantly less in rates than former Wyong Shire Council area ratepayers with the same land value.

Step two: Increase in Council’s rating income

To ensure Council remains financially sustainable Council applied to IPART for an SV rates increase of 15 percent to provide an additional $22.9M in income 2021-22 financial year. IPART approved an SV for three years - it is a temporary one-off increase and is inclusive of the rate peg.

The special variation of 15 percent does not apply to the total amount payable as shown on your Council rates notices. It only applies to the total amount of Ordinary Rates Council can collect (so excludes the Domestic Waste Management charge).

Rates in the Wyong Shire Council area are on average decreasing by 20 percent due to harmonisation. With the 15 percent SV, the average change for ratepayers in the former Wyong Shire Council is a $2 per week decrease.

Rates in the former Gosford City area are on average increasing by 26 percent due to harmonisation. With the 15 percent SV, the average change for ratepayers in the former Gosford City Council is a $8 per week increase.

What about Rate Peg

The amount that Council can increase its rate income each year is set by IPART and called the rate peg. The rate peg for 2021-22 has been set at two percent. This means even without the SV rate increase, Council’s rate income would have increased by two percent.

Segmented Documents

Timeline

Who's listening

Where to find your property’s valuation?

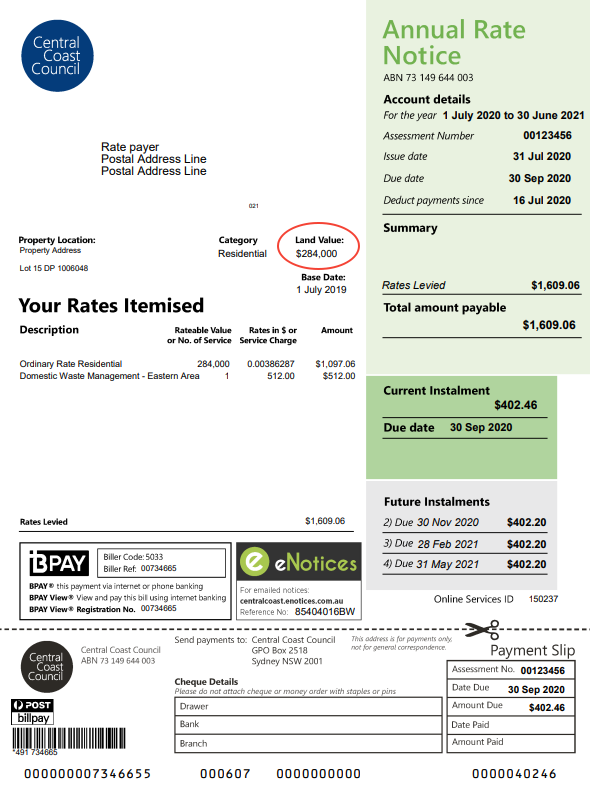

To use the calculator you will need to know the valuation of your property that is set by the NSW Valuer General. This value is based on the land value only and does not include any improvements such as buildings. The valuation of your property can be found on your annual rate notice – the rate notice you receive at the start of the financial year. It does not appear on every rate notice if you pay rates quarterly. (see image below).

You can also find your land valuation from the NSW Valuer General website – select the 1 July 2019 value.

What is rates harmonisation?

Harmonisation means implementing one rating path or structure for the entire Central Coast. So, if your residential land is valued by the NSW Government at $300,000 you will pay the same rates no matter where you live on the Central Coast. Rates charged for each property will still vary depending on the rating category (residential, business, farmland and mining) and your land value determined by the NSW Valuer General, but the property location will no longer be a factor.

Why is Council harmonising rates?

Each year Council collects rates to fund community infrastructure and services. Currently, these rates are different depending on where you live on the Central Coast. Harmonising rates will enable a fairer and more equitable approach to rates collection.

How are the charges on my rates broken down? / what are Ordinary Rates?

Your residential Council rates bill is made up of

- Ordinary Rates (incudes minimum rate + amount based on land value)

- Domestic Waste Management charge

Harmonisation and/or any special variation rate increase applies to Ordinary Rates only.

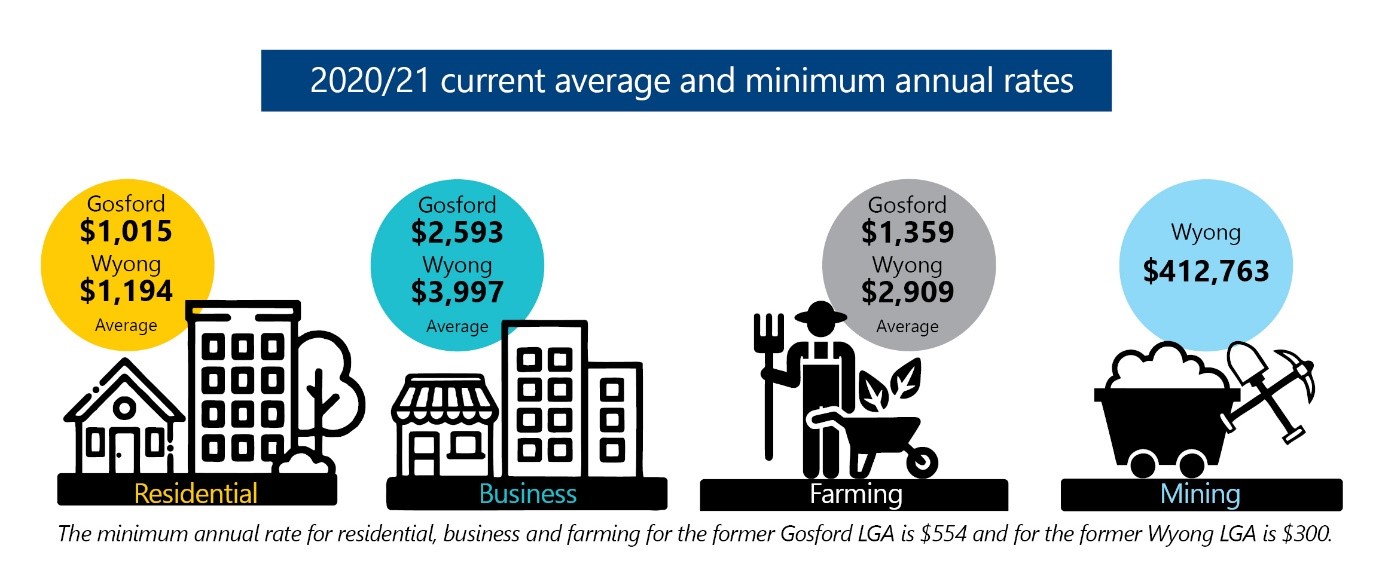

What are the different rating categories?

Every parcel of land in NSW falls within one of four categories for rating purposes and Council is required to categorise each one based on its characteristics and uses.

- Residential - where the dominant use is for residential accommodation (does not include hotels, caravan parks, nursing homes etc). If vacant land is zoned or classified as residential it comes under this category.

- Farmland - where the dominant use of the land is for farming or agricultural production, where the primary production business has a significant and substantial nature and a purpose of making a profit. Hobby farms do not meet the definition.

- Mining - where the dominant use is for a coal or metalliferous mining.

- Business - all land that cannot be classified as farmland, residential or mining.

What about land value? How does land value affect rates harmonisation?

The NSW Valuer General is the statutory independent valuing authority in NSW. The valuation process is something Council cannot influence. Land is valued by the NSW Valuer General under the Valuation of Land Act 1916. These valuations are carried out approximately every three years for rating purposes and you should get a valuation notice once completed. The latest valuation notice was issued in March/April 2020 with land values as at 1 July 2019. These land values must be used for rating from 1 July 2020 to 30 June 2023. Land values on the Central Coast will be reviewed again from July 2022.

Ordinary Rates are calculated based on a variable rate which is applied to the land value of your property. Where the rates calculated is below the minimum rate the minimum rate will apply. The rates are distributed within each rating category based on the land value of individual properties in proportion to the total value of all land within the rating category in the Central Coast LGA.

Increases in land values do not necessarily lead to similar increases in rates. Changes to land valuations will result in a redistribution of the rates levied across categorised properties, but individual rates will change based on the change in your property’s land value compared to the overall change in land values within the rating category of your property.

What if I don’t know my land value or don’t agree with it?

Information about the NSW Valuer General’s valuation process and how to request a review is issued with the valuation notices. It is very important to read that information as it explains what you should do if you have concerns about your valuation and how to go about requesting a review of your valuation. As valuations are provided by NSW Land & Property Information on behalf of the NSW Valuer General who is the statutory independent valuing authority, all enquiries should be directed to NSW Land & Property Information:

Phone:1800 110 038

Website: www.valuergeneral.nsw.gov.au

The NSW Land & Property Information and NSW Valuer General’s Office websites contain information on the valuation process and how to request a review/lodge an objection.

So does my land valuation affect what I will pay under rates harmonisation?

With a new harmonised rating structure from 1 July 2021, Central Coast ratepayers may see an increase or a decrease in their rates dependant on the location and value of the property.

Ratepayers from the former Wyong Shire Council area paid more than ratepayers in the former Gosford City Council area. Will that change with rates harmonisation?

Under rates harmonisation, the creation of a uniform rating structure will mean some of the existing rates will go up and some will go down from 2021-22.

How much Ordinary Rates (less Domestic Waste Management charge) will go up or down due to harmonisation is largely dependent on the value of land.

Former Gosford City Council area residential ratepayers’ land values are on average 43 percent higher than former Wyong Shire Council residential land values. Due to the different rates structure of the former Councils and the rates freeze implemented by the NSW Government, former Gosford City Council residential ratepayers have on average been paying nine percent less for their rates compared to resident ratepayers in the former Wyong Shire Council area.

This means that former Gosford City Council ratepayers have been paying significantly less in rates than former Wyong Shire Council ratepayers with the same land value. This imbalance will be corrected from 1 July 2021 with rates harmonisation.

Following rates harmonisation and the SV increase:

- Rates in the Wyong Shire Council area are on average decreasing by 20 percent due to harmonisation. With the 15 percent SV, the average change for ratepayers in the former Wyong Shire Council is a $2 per week decrease.

- Rates in the former Gosford City Council area are on average increasing by 26 percent due to harmonisation. With the 15 percent SV, the average change for ratepayers in the former Gosford City Council is a $8 per week increase.

It is important to note that the above figures are averages and some rates in Wyong Shire Council will still go up with rates harmonisation, particularly those on the current minimum rate which will be harmonised to $565. For approximately 3,600 ratepayers in the former Wyong Shire Council, mostly unit owners, the minimum Ordinary Rates payment will increase from $300 to $565 a year. In the former Gosford City Council those who paid the minimum of $554 will see this increase to $565.

The harmonised minimum rate of $565 for the Central Coast is set annually by IPART and is the maximum that a Council can charge. This equates to $10.87 per week for the services which Council provides to the community from rates.

What is the minimum rate and who pays it?

Minimum rates are a specific rate, where a minimum amount is levied on each parcel of land, regardless of the land value. This mostly applies to apartments and units, as these dwellings share the land value of the land on which the apartments are built. As a result, they tend to pay substantially lower rates to that of houses. Councils set minimum rates to reduce the gap between what houses and apartments pay in their Local Government Areas. This is because the use of Council services like parks, open space, beaches, and local roads, is available to everyone regardless of whether you live in a house or unit.

Is harmonisation happening regardless of the special variation rates increase?

Yes. Council will have a new rating structure in place by 1 July 2021.

Is rates harmonisation being used to help solve Council’s financial challenges?

No. Rates harmonisation does not result in any additional income for Council. Rates harmonisation redistributes the permitted rates income amongst the ratepayers within each rating category.

Can Council automatically increase rates?

No. The total amount of income any Council can receive from rates is capped by the rate peg set annually by IPART. Council’s rates income can only increase in one of the following ways:

- Rate peg set by IPART (rate peg is the annual amount that Councils can increase rates by; and for 21-22 it is two percent)

- Applying to IPART for a special variation

On 9 February 2021 Council made a decision to apply to IPART for a 15 percent one-off permanent special variation increase (which includes the two percent rate peg). IPART’s approved a 15 percent special variation increase for three years (temporary one-off increase inclusive of the rate peg).

Will I still get the Pensioner Rebate?

Yes. Residents who hold a pensioner concession card are still entitled to apply for a rebate.

What do I do if I have trouble paying my rates?

If you are having difficulty paying your rates, contact us as soon as possible on 1300 463 954 to discuss your situation. Make it clear what you can afford to pay or ask us to put a proposal to you.

Depending on your needs, we can provide you with information about:

- payment options, including help to set up weekly, fortnightly or monthly direct debits

- personal payment plans to help you pay off your overdue rates at the same time as addressing your future instalments in one easy plan

- access to Centrelink’s Centrepay facilities

- referral to financial counselling services

- advice on how to manage your water usage to save money.

Council recognises there are cases of genuine financial hardship requiring respect and compassion in special circumstances.